Politicans Support Rights of Virginia Payday Loan Borrowers

By Paul RizzoPayday Loan Writer

Edwards, D-21st District, has served in the Virginia Senate since 1996, and represents the city of Roanoke, Craig and Giles counties and parts of Montgomery, Pulaski and Roanoke counties. Ware, D-11th District, has served in the Virginia House of Delegates since 2004, represents parts of Roanoke and Roanoke County.

This is their opinion piece on Virginia payday loans, written for The Roankoke Times …

There was a lot of hype about payday lending in this legislative session. We heard stories of abuses where some borrowers had taken out six or seven payday loans at a time and had fallen into a “cycle of debt,” from which they could not recover.

At the same time, we heard stories from individuals who credited the availability of a payday loan with solving an acute financial problem.

Clearly, the payday loan industry needs reforming. But individuals facing a short-term financial crisis need some assistance, and traditional lending sources may not be available for these people.

Many families who live paycheck to paycheck sometimes need a little extra help with financial emergencies. A small [bad credit cash loan] can help repair a car to drive to work, pay an electric bill on time or fix an emergency plumbing problem.

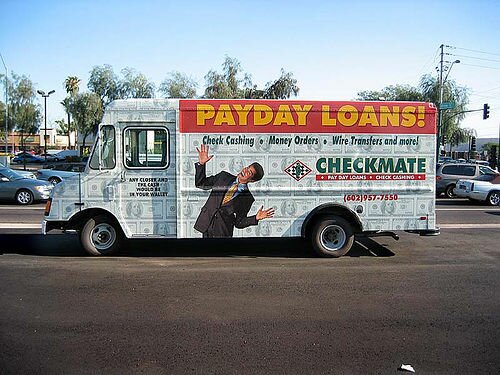

A payday loan is a way a person can get a few hundred dollars on short notice with no credit check and few hassles. Only a bank account and a regular income source are required for a loan up to $500.

Even those who are fighting the payday lending industry admit there is a “niche market” for [no faxing payday loans]. These lenders serve a segment of society who cannot, for many reasons, qualify for traditional loans.

The reform legislation that was proposed in the General Assembly this year would have improved the industry and better protected borrowers.

Senate Bill 1014 would have required the lender to check a database to ensure that an applicant for a loan up to $500 had no more than three payday loans outstanding at one time. No loan could have been “rolled over,” and a borrower would not have been able to take out another payday loan on the same day that the borrower paid off the existing loan.

If a borrower obtained three or more consecutive payday loans (within five days of each other), the borrower would have been entitled to receive an extended payment plan to repay the [cash advance] over a period of 60 days without added charges.

The bad news: Predatory payday lending is still alive in Virginia, at least until our next General Assembly session. Every year this problem goes unaddressed,

The bad news: Predatory payday lending is still alive in Virginia, at least until our next General Assembly session. Every year this problem goes unaddressed,

Rather than let that happen, the bill vanished into the thin air of legislative legerdemain.

Rather than let that happen, the bill vanished into the thin air of legislative legerdemain.

Governor Tim Kaine said today he would make “significant changes” to a package of

Governor Tim Kaine said today he would make “significant changes” to a package of  Sen. Richard L. Saslaw’s industry-backed bill is the only one remaining out of more than a dozen introduced this year to either reform the industry or repeal the 2002 law that allowed providers of

Sen. Richard L. Saslaw’s industry-backed bill is the only one remaining out of more than a dozen introduced this year to either reform the industry or repeal the 2002 law that allowed providers of  Ware objected to the amendment to cap the interest rate on the

Ware objected to the amendment to cap the interest rate on the