Payday Loan Ordinance Voted Down in Arizona

By Paul RizzoPayday Loan Writer

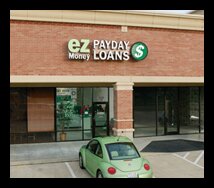

Payday loan stores remain unfettered in Mesa, AZ.

A 4-3 vote by the City Council at Monday's meeting defeated an ordinance, championed for weeks by Vice Mayor Claudia Walters, which would have prohibited the no credit check payday loan operations from building within 1,200 of one another.

The law would have restricted only new shops.

When Mayor Keno Hawker read the tally aloud, Walters stared at the floor, lips pressed tight. Mitzi Pearce, a 53-year-old computer operator, groaned as she sat in the audience.

When Mayor Keno Hawker read the tally aloud, Walters stared at the floor, lips pressed tight. Mitzi Pearce, a 53-year-old computer operator, groaned as she sat in the audience.

There were many watching that were against the spread of cash loan stores - just not enough on the board.

Councilman Tom Rawles made good on his September promise to vote against the ordinance. He told the crowd that he agreed with residents who said there are too many of them in Mesa. He, too, wants the Arizona Legislature to constrain their operation.

But for now, they are legal businesses. So, the government has no right to micromanage the marketplace by limiting providers of cash advance loans in such a way, Rawles said.

"There's no empirical evidence of declining property values (due to payday loan stores)," he said, explaining his vote. "There's no empirical evidence that clustering will force other businesses to flee. So why is everyone upset?"

Because people worry about the poor and minority population that frequents those businesses, he continued.

"Public policy should not be based on discrimination."

The payday cash advance vote surprised Councilman Scott Somers, who voted with Rawles. He expected a 4-3 vote the other way.

"Spreading them out isn't going to solve their predatory practices," he said. "And I'm worried about the unintended consequences of limiting competition. Interest rates could go even higher."