Senator Calls for Payday Cash Advance, Predatory Lending Reform

By Paul RizzoPayday Loan Writer

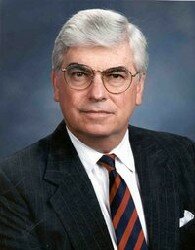

The government must reform lending practices - such as those involving payday cash advances - that prevent the poor from saving money and owning a home, said Senator Chris Dodd, (D-Conn., pictured) the incoming chairman of the Senate committee on banking, housing, and urban affairs.

It may take a new law to do so, if pressuring financial services companies and other bad credit payday loan lenders to alter their lending practices doesn’t yield results, he said.

“I’m not overly anxious to pass legislation,” Dodd said to reporters after a speech on Tuesday. But if the problems aren’t fixed, he added, “the law will be changed.”

The White House hopeful - who repeated Tuesday that he will make a final decision on whether to run in the 2008 presidential election “probably in the coming days” - spoke at the 10th annual Wall Street Project economic summit held in Midtown Manhattan.

Wall Street Project is a group run by the Rev. Jesse Jackson and his Rainbow/PUSH civil rights organization that aims to ensure equal opportunity for minority employees, consumers and entrepreneurs.

Jackson, as well as the Rev. Al Sharpton, attended Tuesday.

Dodd said his goals as chairman included getting Wall Street firms to work with the Wall Street Project to increase low-income families’ access to capital, and holding hearings on “predatory” lending practices, including faxless payday advance lending and the credit card industry’s targeting of those who can’t pay off their bills.

Unfair lending practices have come under fire in recent years as mortgage delinquencies and foreclosures surge.

The trend is expected to continue: in December, the Center for Responsible Lending predicted that lenders will foreclose on nearly a fifth of the subprime mortgage loans - high-interest home loans given to people with poor credit - issued in 2005 and the first three quarters of 2006.

“For these people, the American dream can truly become a nightmare, in a sense,” Dodd said.

Studies show minorities get high-cost mortgages more than whites do regardless of credit scores, he said, a statistic caused by “racist attitudes that exist.”

A study conducted by the University of Denver released on Tuesday said the more than 130 million Americans without prime credit scores - the kind needed to get a low-cost personal loan - are disproportionately African-American and Hispanic.

Additionally, Dodd said after his speech that he wants to hold hearings to discuss whether company shareholders should have a greater say in executive compensation.

“It’s a concern — how can it not be?” he said, pointing out that the large Christmas bonuses doled out to Wall Street are bigger than some community’s budgets.

Political analysts expect Dodd, whose home state of Connecticut is the insurance capital of the country, to make new fundraising connections on Wall Street as the chair of the banking committee, should he decide to run for president.

We’ll report on how any of this affects the cash loan industry.